A February to Remember: Bitcoin Dominates the Limelight

Key Takeaways

- Bitcoin dominates the limelight as adoption soars as big institutional players flock to the crypto

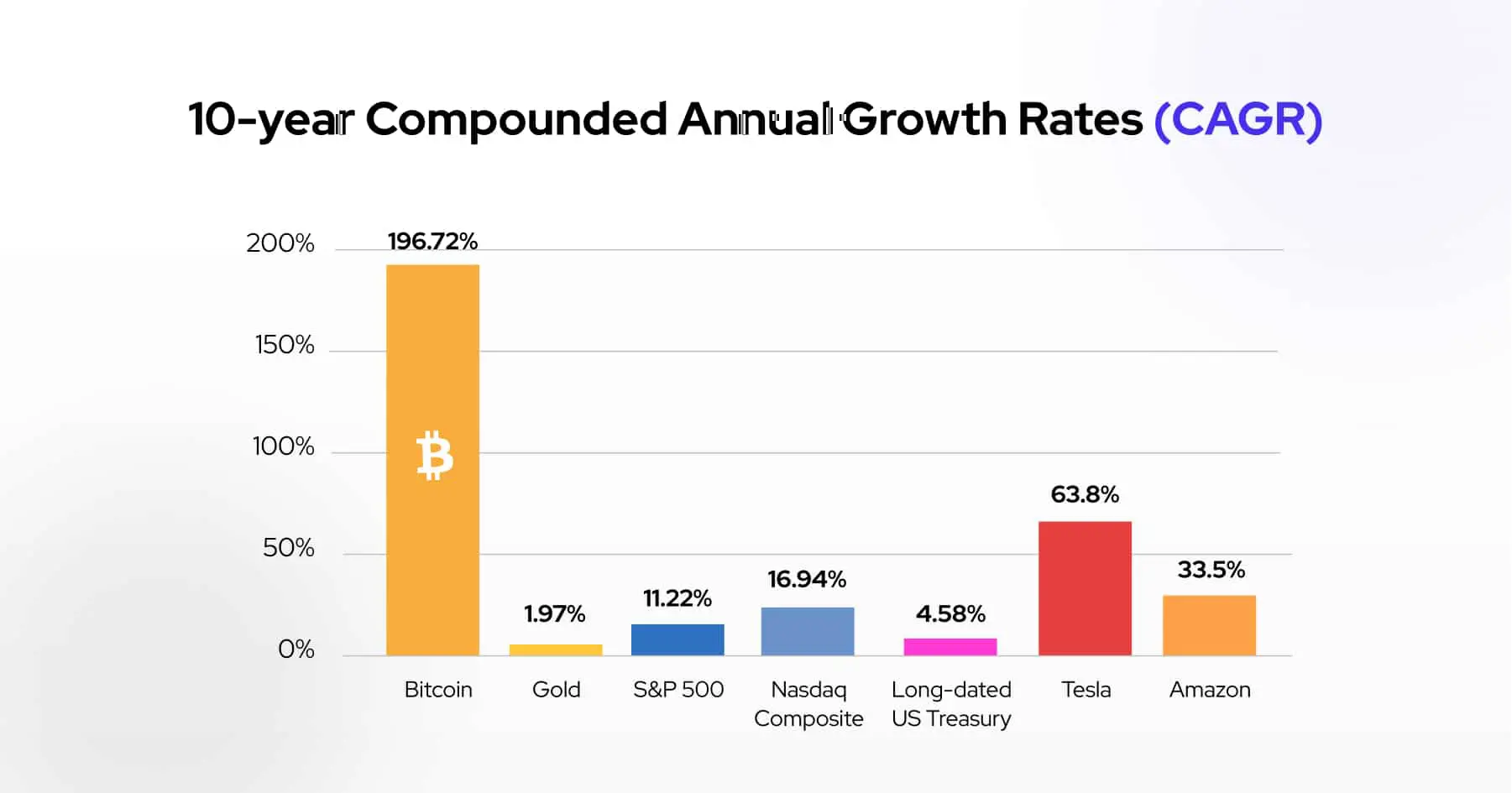

- BTC sees CAGR of almost 200% over the past decade

- Bitcoin fights its way into mainstream with a show-stopping performance

The Grammy award for best performance goes to none other than the king of crypto, Bitcoin.

BTC who for years was seen as an asset preceded for its volatility begins to gain momentum. 12 years on from its inception and the crypto (notably the most revolutionary creation of our time) is now defined as a store of value and a hedge against inflation. Let us add perspective since 2009 Bitcoin has transacted $10 trillion like clockwork and without a single error. The banking system, on the other hand, $32 billion transactional errors, which was just 2020. Makes us think right. Furthermore, BTC has delivered returns that are “unheard of” in the financial sector. Those that have hodled, made. BTC has a compound annual rate (CAGR) of almost 200% over 10 years. This means investors would have tripled their investment each year of the last decade. From all-time highs and increased adoption, February 2021 is a month that will forever go down in crypto history.

IMAGE: Bitcoin 10-year CAGR chart. Source: CaseBitcoin/Twitter

Tesla Sinks $1 Trillion into BTC

In early February, the world was sent into a frenzy when business mogul Elon Musk turned hot on BTC. A string of anarchy (tweets) sent the digital assets rocketing and opened the floodgates for other Fortune 500 companies to get on the wagon. Tesla’s pledge to invest $1.5bn, an investment that returned $725 million in just one month put the wheels in motion for what turned out to be a blockbuster month.

Is Amazon set to Revolutionize yet Another Industry?

Amazon who is already known for its impact across the internet economy is now making moves on the currency industry. It appears that the eCommerce giant is preparing to launch a “digital currency” venture in Mexico.

The yet-to-be-announced project is Amazon’s way of keeping profitable Prime customers eternally plugged into the platform. If rolled out the Amazon customers will be able to exchange cash into crypto that can then be used to shop for goods and services such as Prime Video etc. Amazon would only mean great things for BTC. Amazon has changed the way we shop online and BTC has changed the way we transact, marry them together and you could have the perfect love story.

PayPal Doubles Down

This is not PayPal’s first foray into the cryptocurrency space. They first announced the plan to introduce cryptocurrency to a user base of 26 million. CEO, Dan Schulman recently shared his optimism in which he cited “the strategy for 2021 is simple – double down on cryptocurrencies, blockchain, and digital currencies”. The payment platform’s adventure in crypto thus far has exceeded expectations. In November they allowed their US customer base to make direct purchases of cryptocurrencies. This initiative achieved a record in transaction volume – As of January 2021, transaction volumes were a whopping $242,000,000.

Mastercard & Visa Avoid the FOMO

On Feb 10th Mastercard announced its plans to accept a select few cryptocurrencies on their payment system. The payment behemoth stated that this would allow customers to save, store and send money, at the same time opening opportunities for merchants. Mastercard’s decision to join the crypto arena followed Visa’s reaffirmation of their plans to continue to push for digital asset payments and on-ramps.

MicroStrategy Increase Their Stake

MicroStrategy bought its first Bitcoin in August, steamrolling the path for the recent interest from other big institutional investors. The tech firm has now announced that they have purchased over $1 billion worth (approx.19,452 BTC) of additional Bitcoin. This investment now sees its tally jump to 90,531 Bitcoins. This was shortly followed by a purchase from Square, which is said to have bought $170 million worth of the cryptocurrency.

Fighting its Way into the Mainstream

So, what exactly is the recipe for mass adoption? Is it interest from institutional investors, or the retail trading community? Or perhaps it’s the wild price ascends that get people’s blood flowing? Irrespective of the reason, BTC is here to stay, and as the crypto evolves popularity will follow. BTC is borderless and offers users a fast and secure way to transact. BTC is changing the way we do finance, similar to how the internet revolutionized the way we communicate, BTC is changing the way we do finance. There is no escaping it, crypto is very much a part of the 21st century. You will hear it mentioned in the news or on social media, heck even your friends and family are spreading the “BTC” word. It is hard to know what the future holds, but we still think the future looks “crypto”.

To BTC or not to BTC?

Bitcoin has been the most exemplary innovation of the ages. Some might argue that it’s still in its infancy. Nonetheless, the crypto has shown nothing but resilience in its 12-year lifespan. We believe that the future of finance is unfolding before our very eyes. A market cap of over $1 trillion in as little as 12 years, a milestone that took tech biggies such as Google (22 years) and Microsoft (45 years). Do you really want to miss out on the rapid growth that BTC has to offer? Make the transition from traditional to digital, buy Bitcoin today, and be part of the evolution as it continues to expand.